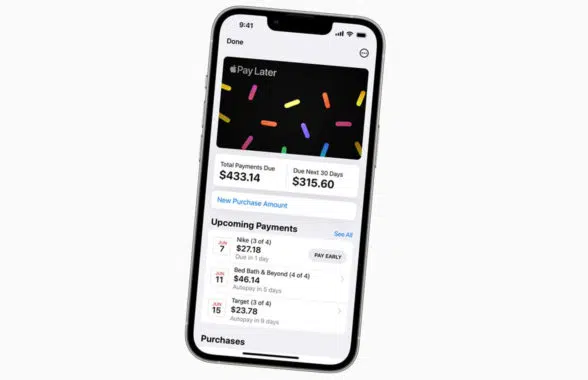

Apple iPhone users in the US will soon be able to opt to spread payments for purchases made using Apple Pay over a period of six weeks in four equal instalments using a ‘buy now, pay later’ service integrated into Wallet... More

- Apple Pay users in the US to get buy now pay later option with iOS 16

- BIS reports on CBDCs in emerging markets

- Moroccan bank launches biometric payment card

- US digital bank introduces contactless payments rings

- Riksbank completes digital currency payments pilot

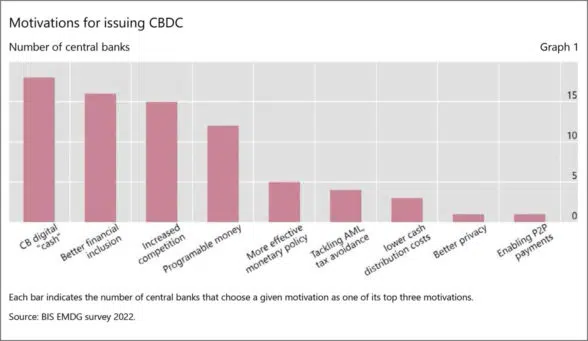

BIS reports on CBDCs in emerging markets

Providing a cash-like digital means of payment, increasing private digital payment services, supporting financial inclusion and achieving greater payment system efficiency are among the key motivations driving initiatives to develop central bank digital currencies (CBDCs) in emerging market economies around the world, according to a Bank for International Settlements (BIS) report... More

Moroccan bank launches biometric payment card

Customers of BMCI bank in Morocco can now apply for a biometric payment card that allows them to authenticate contactless payments with their fingerprint... More

US digital bank introduces contactless payments rings

Customers of US-based digital bank Quontic can now opt to order a contactless payments ring that they can link to their checking account and use to make purchases wherever contactless payments are accepted... More

Riksbank completes digital currency payments pilot

Sweden’s central bank The Riksbank has completed the second phase of its e-krona central bank digital currency (CBDC) pilot and demonstrated that the blockchain-based technical solution it is testing can be integrated into existing banking and payments infrastructure... More

Keep up to date: Get NFCW's headlines by email every Wednesday

Apple Pay is most popular payments app with Generation Z in US

Apple Pay is the most popular payments app with Generation Z teenagers in the USA, followed by Venmo in second place, Square’s Cash App in third and PayPal fourth, according to a survey published by Piper Sandler investment bank... More

National Bank of Iraq to trial biometric payment cards

The National Bank of Iraq is to pilot biometric payment cards that will allow users to authenticate contactless transactions with their fingerprints... More

Dubai merchants to let customers make payments with face biometrics

Consumers in Dubai in the United Arab Emirates will soon be able to make contactless payments with their face at branches of Costa Coffee, drinks retailer MMI, grocery chain Géant, the Cove Beach at Caesars Palace beach club and the Coca-Cola Arena Dubai... More

European Commission requests payments industry input on digital euro

The European Commission has launched a targeted consultation on the expected impact of a digital euro on key industries, institutions, consumers, merchants and other stakeholders in international trade. More

Apple Pay goes live in Moldova

Apple Pay has launched in Moldova with support for Mastercard and Visa cards issued by Maib, Moldindconbank and Victoriabank. More

Jamaica begins central bank digital currency rollout

Residents of Jamaica can now open a digital wallet that supports the country’s Jam-Dex central bank digital currency (CBDC) as the Bank of Jamaica (BOJ) prepares to launch the CBDC during the April to June quarter... More

Contactless P2P payments to drive adoption of digital euro, central bank survey finds

European consumers consider the ability to make instant contactless payments, including person-to-person transfers, to be a priority and “a very important selling point” for a digital euro, according to European Central Bank (ECB) research. More

Keep up to date: Get NFCW's headlines by email every Wednesday

Apple to enter payment processing market?

Apple has launched a project to develop its own payment processing technology and infrastructure for future financial products and services including buy now, pay later instalment payments for Apple Pay, credit checking and risk assessment, according to media reports. More

Google Pay lets users in India make contactless mobile payments directly from their bank account

Google Pay users in India can now choose to make in-store mobile payments with their Android NFC smartphone directly from their bank account using the country’s Unified Payment Interface (UPI) real-time mobile payments service. More

Qatar and the Philippines move towards developing CBDCs

The Bangko Sentral ng Pilipinas (BSP) is to launch a central bank digital currency (CBDC) pilot project “in the near term” and the Qatar Central Bank (QCB) is also exploring the possible development of a CBDC in line with its wider payment digitisation plans... More

Apple Pay and Google Pay suspend contactless mobile payments for Mir cardholders in Russia

Apple Pay and Google Pay are suspending support for contactless mobile payments made using Mir cards issued by Russia’s National Payment Card System (NSPK)... More

Bangladesh switches on support for contactless debit and prepaid cards

The central bank of Bangladesh has announced that it has added approval for contactless debit and prepaid card payments in a circular that also sets a PIN-free transaction limit of Tk3,000 (US$35) and requires card issuers to notify customers of each transaction via SMS. More

Hindu temples pilot contactless payments in India

Devotees will soon be able to make contactless offerings and other charitable payments at some 536 Hindu temples across India using a QR code-based payment system being piloted by the Hindu Religious and Charitable Endowments Department... More

Apple acquires open banking provider Credit Kudos

Apple has acquired Credit Kudos, an update to the UK-based open banking provider’s website reveals, describing the company as “a subsidiary of Apple” and confirming media reports... More

Banks develop interoperable platform for cross-border CBDC transactions

The Bank of International Settlements and the central banks of Australia, Malaysia and Singapore have completed a joint project to develop a shared platform that could facilitate direct cross-border transactions between institutions using different central bank digital currencies (CBDCs)... More