79 news stories.

• Should Alipay be in the NFCW Expo? Is this your organisation? Find out how to get your NFCW Expo showcase.

• Should Alipay be in the NFCW Expo? Is this your organisation? Find out how to get your NFCW Expo showcase.

The Monetary Authority of Singapore (MAS) is testing an upgraded version of its SGQR unified QR payment code that will enable merchants to accept QR code payments made using a wider range of local and cross-border payment schemes through a single financial institution rather than having to maintain commercial relationships with individual payment scheme providers... More

Visitors to China can now link their international credit cards, including cards issued by Visa, Mastercard, JCB and Discover, to an Alipay or WeChat Pay digital wallet and use them to make payments for goods and services at merchants across the country... More

More than 130,000 pairs of Nike shoes have been produced containing an embedded dynamic NFC chip that connects each product to a digital twin that can be used to authenticate the product and trace its provenance... More

The total transaction values for payments made using QR codes worldwide will reach more than US$3tn by 2025, an increase of 25% from US$2.4tn in 2022, driven by an increasing focus on financial inclusion in developing markets and alternative payment methods in developed regions, according to a forecast by Juniper Research... More

PayPal, followed by Alipay, are the top two digital wallet providers, with WeChat Pay, Apple Pay and Google Pay in third, fourth and fifth place, respectively, according to a Juniper Research Competitor Leaderboard report... More

Nearly 21m (20.87m) personal and 3.51m corporate digital yuan wallets have so far been issued during China’s ongoing trials of its central bank digital currency (CBDC), the People’s Bank of China (PBOC) has revealed... More

Customers of all six state-owned Chinese banks can now apply for test versions of the banks’ digital yuan wallets as the country rolls out the next phase of its central bank digital currency (CBDC) pilot programme in the city of Changsha... More

Owners of Huawei’s Mate 40 in China will be able to make transactions in digital yuan from a central bank digital currency (CBDC) hardware wallet built into the soon-to-be-released smartphone... More

The People’s Bank of China (PBOC) has “found counterfeit digital yuan wallets on the market,” the head of the bank’s digital currency research institute Mu Changchun has revealed... More

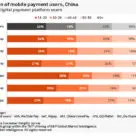

While Alipay and WeChat Pay have by far the largest number of mobile payments users in China overall, younger and more affluent consumers are more likely to use less well known services such as Du Xiaoman Pay and QQ Wallet, an in-depth market analysis by S&P Global has found... More

Asia is leading the way in the use and development of digital currencies and remains the world’s largest digital payments market, with China alone accounting for more than half of the total transaction value worldwide, according to a new research paper published by Singapore’s DBS Bank... More

Face-based payments offer the potential to improve customer convenience and increase checkout speeds in stores but require consumer education to be built into the user experience to alleviate security concerns, an in-depth study of services currently on offer in China has found... More

Chinese mobile payments giant Alipay has announced a three-year plan to evolve its current offering into an open financial services and digital lifestyle platform — and has set a target of attracting 40m service providers by 2030... More

A solution that uses NFC shelf-edge labels to let passengers self-checkout and pay for their shopping using their mobile phone is undergoing pilot testing at Munich Airport... More

Italy’s national postal service provider has added QR code-based payments to its mobile payments app, to support the country’s transition from cash to digital payments... More

Tencent, the owner of Chinese mobile payments provider WeChat Pay, has announced that it is working with Visa, Mastercard, American Express, Discover and JCB to enable cardholders to connect their payment cards to WeChat Pay and then use the platform to make mobile payments when visiting China... More

Tourists visiting China can now use a version of Alipay designed specifically for international travellers to make mobile payments during their trip, Alipay has announced... More

In depth: The fight for dominance in China’s mobile payment market — Caixin Global — “Under the plan, by the end of 2021 all merchants will be able to use one universal barcode to facilitate transactions through different payment service providers, including banks, Alibaba’s Alipay and Tencent’s WeChat Pay. Currently, payment providers issue different barcodes that can be used only on their own services.”

Alipay and its local e-wallet partners now collectively serve 1.2 billion users globally, Ant Financial has revealed, up 20% since the end of December 2018 and 260% over the past three years... More

Alipay adds a beauty filter to its facial scan payment system to encourage more female users — Radii China — “The move came after Sina Weibo’s tech channel pointed to data that showed male adoption rates of facial scan payments on Alipay were higher than those for females. ‘Be honest, when you’re using the facial payment option, do you think you’re ugly?’ asked the account via a poll. After more than 40,000 people voted, the poll showed that over 60% felt the payment method made them look ugly and ‘not as pretty as when taking a normal photo’.”