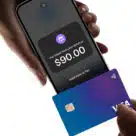

Apple users travelling on public transport services operated by Transport for NSW in the Australian state of New South Wales can now make contactless payments for their journeys with their iPhone or Apple Watch without needing to unlock their device... More