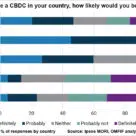

US Consumer Financial Protection Bureau proposes new rule to oversee Big Tech digital wallet and payment app providers

The US Consumer Financial Protection Bureau (CFPB) is proposing to subject large non-bank companies that offer consumer finance services including digital wallets and payment apps – such as Apple and Google – to the same regulatory scrutiny and oversight as banks, credit unions and other financial institutions... More