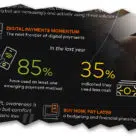

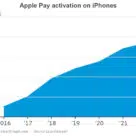

NFC Forum survey finds majority of consumers now prefer making payments with their mobile phone

More than 80% of the respondents to a survey conducted by ABI Research on behalf of the NFC Forum said they have used a smartphone or smartwatch to make a contactless payment... More